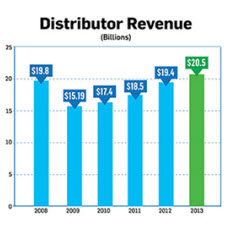

Sales of promotional products up 5.3% from 2012;

Suppliers and Distributors post 16 straight quarters of growth

TREVOSE, PA – April 15, 2014 – The Advertising Specialty Institute® (ASI) today released its annual sales analysis for the promotional products industry, showing total sales of $20.5 billion for 2013, up 5.3% from 2012, with continued strong sales forecast throughout 2014.

Leading research firm eMarketer ’s estimates for media spend by category suggests total distributor sales of $20.5 billion puts promotional products third among all advertising media, behind TV and digital, the same ranking as 2012, when sales were $19.4 billion.

Sales of promotional products have now increased for 16 straight quarters, according to ASI supplier and distributor sales reports. Fueled by sales of branded items like T-shirts, caps and pens that companies typically give away to promote their brand or event, the promotional products industry is growing at over twice the rate of the U.S. economy.

Meanwhile, the Counselor® Confidence Index – a tool that measures distributor health and optimism – improved to 113.2 in the fourth quarter, just shy of the all-time high reached in 2006.

“It’s clear the entrepreneurs and small business owners at the heart of our industry are bullish on the industry and more optimistic than ever,” said Timothy M. Andrews, president and chief executive officer of ASI, the largest media, marketing and education organization serving the promotional products industry, with a network of over 25,000 distributors and suppliers throughout North America. “ASI is proud to play a continued part in celebrating the success of distributors, suppliers, decorators, screen printers and line reps who help America’s businesses promote themselves through low-cost, high-impact ad specialties, which still cost as little as half a penny per impression.”

According to ASI reports, generally, as the size of a distributorship increased, so did the proportion with higher sales in 2013 than 2012. Over 86% of larger distributors (over $5 million in sales) reported an increase, compared to less than two-thirds (65%) of smaller distributors (less than $250,000 in sales).

“Our overall experience is that we saw growth greater than the industry average,” Jo-an Lantz, executive vice president of Top 40 distributor Geiger (asi/202900), told Counselor PromoGram. “We anticipate another great sales year in 2014. The industry will have another growth year, and we are expecting the same.”

Highlights of ASI’s 2013 sales analysis include:

• During the fourth quarter, there was a 5.7% year-over-year increase in sales among ASI distributor members. The largest distributorships again reported the highest percentage increase in sales (6.6%). Over one-half (54%) of all distributors reported an increase in total sales for the fourth quarter.

• Distributors are optimistic about sales for 2014, particularly the largest distributors. Nearly three-quarters (74%) of all distributors feel sales in 2014 will be higher than sales in 2013, while 86% of distributorships with at least $5 million in revenue expect an increase in sales.

The U.S. Department of Commerce reports that real GDP – which measures output produced in the U.S. – grew at an annual rate of 2.6% in the fourth quarter of 2013. Averaged across the four quarters of last year, real GDP added 1.9% in 2013 from 2012. Economists predict the U.S. economy will grow by 3% in 2014, the fastest rate of expansion since 2005. By contrast, the promotional products industry was up 5.3% from 2012 to 2013.

Click here to read the entire exclusive survey, which ASI commissioned to estimate industry sales for 2013 and the outlook for 2014. Invitations went to ASI distributor members who were the primary contact with their firms, and had been in business at least one year.

ASI’s most recent Global Advertising Specialties Impressions Study on ROI shows promotional products consistently rank among the most influential, enduring and cost-effective ad mediums available.

To learn more about ASI research and sales analysis, contact Nathaniel Kucsma, ASI’s director of marketing research, at nkucsma@asicentral.com.

Published on: April 28th, 2014